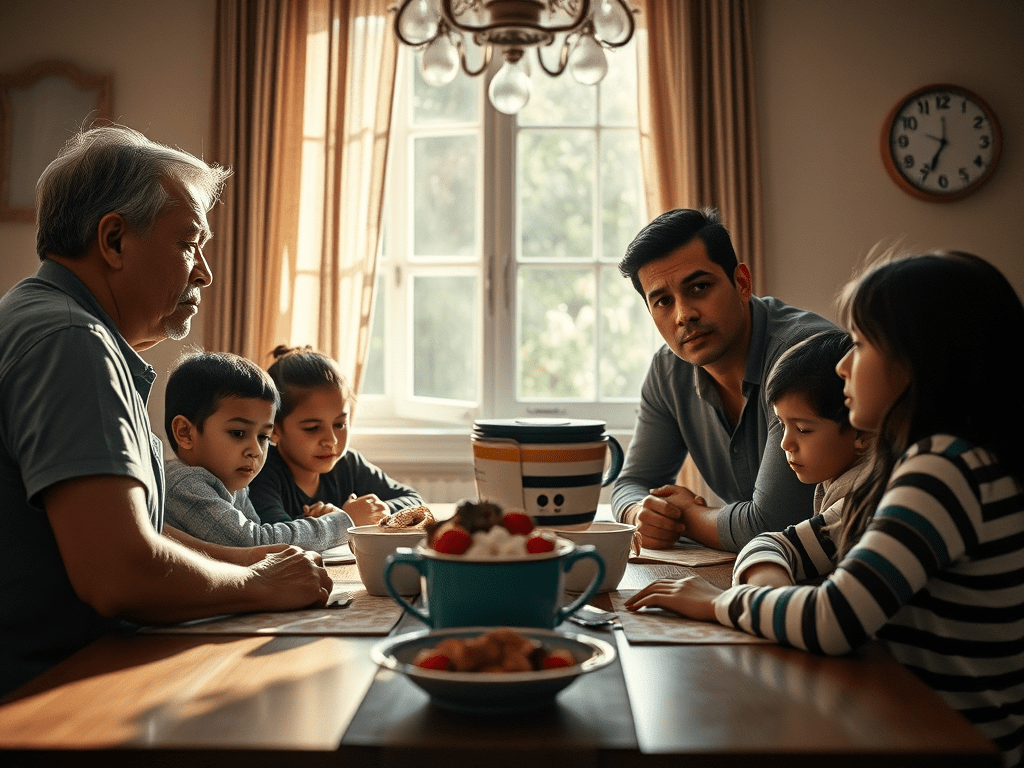

Many Latinos grow up with an unspoken awareness of money — not because we were taught financial literacy, but because we were made to feel financial stress from a very young age.

For many Latino and Hispanic families, money was always tight, and parents often reminded their children of that reality. Phrases like “el dinero no alcanza,” “cuestas mucho,” or “no sabes lo difícil que es mantenerte” may not have been meant to cause harm, but over time they can create deep financial trauma. The message absorbed is often: you are a financial burden.

As children, we had no control over our parents’ financial readiness, yet many of us grew up carrying guilt, responsibility, and anxiety around money. This experience is especially common among first-generation Latinos, where survival stress and lack of resources shape family dynamics.

How Financial Trauma Shows Up in Latino Adults

Growing up hyper-aware of your family’s financial situation often leads to one of two money patterns in adulthood:

1. Spending With Guilt

Some adults finally allow themselves to spend money — on necessities or small pleasures — but feel immediate shame afterward. Thoughts like “I shouldn’t have spent that” or “I don’t deserve this” reflect how deeply money guilt is tied to self-worth.

2. Emotional Spending

Others spend money they don’t have on things they don’t need, not out of irresponsibility, but to temporarily soothe emotional pain. This is a common trauma response linked to financial anxiety, not a lack of discipline.

Both patterns are coping strategies rooted in early experiences of financial stress in Hispanic households.

The Role of Financial Literacy in the Hispanic Community

In many Latino homes, money is talked about constantly — but rarely taught. Conversations focus on scarcity, debt, and sacrifice, rather than budgeting, saving, or long-term planning. Financial literacy in the Hispanic community is often missing, not because parents didn’t care, but because they themselves were never given the tools.

When financial stress is paired with emotional pressure placed on children, money becomes tied to identity, worth, and belonging. This creates long-lasting patterns of financial anxiety, people-pleasing, and overworking.

This Is Not a Personal Failure

If you see yourself in these patterns, it’s important to name this clearly: this is not a personal failure. These behaviors are shaped by generational trauma, cultural expectations, and survival-based parenting — not by laziness or irresponsibility.

Healing your relationship with money often requires addressing the emotional wounds underneath the numbers.

Healing Financial Trauma as a First-Generation Latino

Healing may include:

- Recognizing how childhood money messages still affect you

- Separating self-worth from financial productivity

- Learning financial literacy without shame

- Processing family guilt and emotional responsibility

- Creating a new narrative around money and security

Healing doesn’t mean rejecting your culture. It means understanding it with compassion — for yourself and the generations before you.

Therapy for Financial Trauma and First-Generation Issues

For many Latinos, financial trauma is deeply connected to family roles, identity, and unmet emotional needs. Therapy can help you unpack these experiences, reduce guilt, and build a healthier relationship with money and yourself.

At Willow & Sage Counseling, we specialize in therapy for first-generation Latinos, trauma, and family-related stress. If this resonates with you, support is available — and you deserve it.

Leave a comment